The world of online trading is fast-paced, and many investors are looking for smarter, simpler ways to gain market exposure. That’s where PAMM accounts—otherwise known as Percentage Allocation Money Management accounts—come into play.

Whether you’re new to forex or want to diversify your trading strategy, PAMM accounts can offer an alternative way to gain market exposure by allocating funds to independent money managers, though performance is not guaranteed.

In this guide, we’ll walk you through what PAMM accounts are, how they work, and how to evaluate options based on your goals and risk tolerance for your trading strategy.

What is a PAMM Account?

A PAMM (Percentage Allocation Management Module) account is a type of investment solution where a professional trader who act as a money manager trades on behalf of one or more investors. Each investor’s share of the profits (or losses) is proportional to the amount they have invested.

Think of it as pooling your funds with others under the management of an experienced trader, where profits and losses are distributed proportionally based on your contribution.

How Do PAMM Accounts Work?

When you invest in a PAMM account, you assign a portion of your funds to a professional money manager, who trades on your behalf. The manager executes trades using their chosen strategy, and any profits or losses are proportionally distributed to you based on your share of the total invested capital.

The PAMM system offers a high level of transparency and flexibility—you can choose your manager based on their performance history, risk profile, and trading style—allowing you to align your investment with your own financial goals

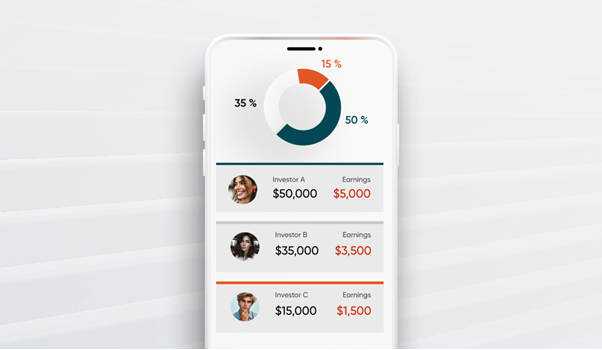

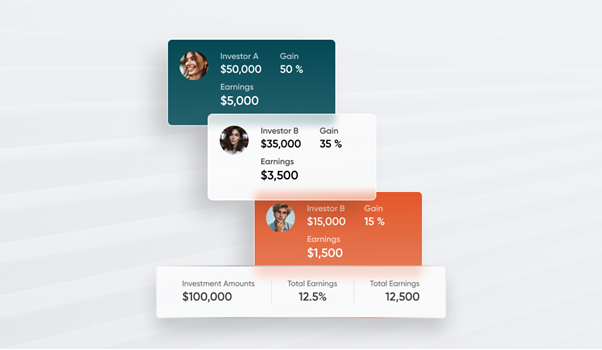

Let’s break it down with a simple example.

Three investors—Investor A, Investor B, and Investor C—want to trade in the forex market, but they prefer to have a professional manage their money. So, they each open a PAMM account and choose the same money manager.

Here’s how much each investor contributes:

- Investor A: $50,000

- Investor B: $35,000

- Investor C: $15,000

That gives a total pooled investment of $100,000.

Assuming the manager earns a 12.5% profit on the total amount during the investment period. That’s $12,500 in gains.

The manager charges a 20% performance fee, which is $2,500. That leaves $10,000 to be shared among the investors.

Since each investor owns a percentage of the pool, they receive a share of the profits based on how much they invested:

- Investor A (50%) receives $5,000

- Investor B (35%) receives $3,500

- Investor C (15%) receives $1,500

Why Choose a Vantage PAMM Account in South Africa?

With so many PAMM providers available, choosing the right one can feel overwhelming. For South African traders, Vantage offers a tailored PAMM experience that combines global expertise with local support and market understanding.

Let’s explore what sets Vantage apart.

1. Experienced Money Managers

Our PAMM managers are carefully selected based on their trading experience and performance history.

While past results are not indicative of future performance, based on their previous trading activity, deep market knowledge, and disciplined approach may be reflected in their trading strategy, though all trading decisions are made independently of Vantage and results are not guaranteed.

2. Competitive Fee Structures

We believe in transparency. That’s why our PAMM accounts come with clear and competitive commission models—so you always know what you’re paying and why.

3. Secure and Regulated Platform

Your peace of mind is our priority. Vantage is regulated by top-tier financial authorities in South Africa and internationally, ensuring your funds are securely held in segregated accounts within a regulated trading environment.

4. Localised Understanding

As a broker with both global presence and local expertise, we understand the unique needs and preferences of South African traders. From region-specific funding options to tailored platform support, we’re committed to making your PAMM experience as seamless as possible.

5. Dedicated Local Support

Need help? Our dedicated support team operates in your local timezone and is trained to assist with PAMM-related inquiries. Whether it’s account setup or platform guidance, we’re here to assist you every step of the way.

6. Integration with Leading Trading Platforms

Vantage PAMM accounts are fully integrated with MetaTrader 4 and MetaTrader 5— platforms trusted by South African traders. Enjoy real-time tracking, advanced charting tools, and a seamless user experience.

7. Performance Transparency

We provide access to comprehensive performance data and trading histories for all PAMM managers. You can view key metrics like historical returns, risk levels, and trade frequency—providing insights that clients can use to assess past activity and make independent decisions.

5 Benefits of PAMM Accounts for South African Traders

Investing through a PAMM account isn’t just about convenience—it also offers tangible benefits that align with the financial goals of many South African traders.

Let’s look at five key advantages.

1. Access to Expertise

With PAMM, you’re not going it alone. You get access to seasoned professionals who live and breathe the markets, making decisions based on their own trading experience and analysis, though clients should evaluate strategies independently.

2. Potential for Passive Income

You don’t need to actively trade to earn returns. Your money manager does the heavy lifting while the manager executes trades in line with their strategy. Performance may vary, and past returns do not guarantee future outcomes.

3. Access to Global Markets

Many South African traders face limitations when it comes to accessing global markets. PAMM accounts open doors to international trading opportunities you might not reach on your own.

4. Diversification Opportunities

PAMM accounts allow you to diversify not just across multiple assets, but also across strategies and account managers. By allocating funds to different PAMM accounts, you can spread risk more effectively and reduce reliance on a single trading style or market condition.

Related Article: A Guide to Portfolio Diversification

5. Time Efficiency

Whether you’re running a business or balancing family life, PAMM accounts offer a practical way to stay invested in the markets—without the need for constant monitoring or hands-on management. Once you’ve selected a strategy, your chosen manager executes trades accordingly. Clients should still monitor performance regularly to ensure alignment with their goals.

The Bottom Line: Choose the Best PAMM account in South Africa

PAMM accounts offer a convenient, hands-off approach to participate in the markets that aligns well with the needs of many South African traders in 2025. But not all PAMMs are created equal.

Choosing a forex CFD broker like Vantage means accessing a secure, performance-driven platform supported by local insight and global trading expertise.

Related Article: Advanced Forex Trading Strategies

How to Get Started with the Vantage PAMM Account

Ready to take the next step? Getting started with a Vantage PAMM account is simple:

1. Open a live trading account with Vantage.

2. Select a PAMM manager based on your goals and risk appetite.

3. Allocate your funds and track performance in real time.

4. Withdraw potential profits or reinvest as needed.

PAMM Account FAQs

Is Vantage Regulated in South Africa?

Vantage Markets (Pty) Ltd is authorised and regulated by the Financial Sector Conduct Authority (FSCA) of South Africa under license number 51268.

How Do I Withdraw Money From My PAMM Account?

Withdrawals from your Vantage PAMM account are straightforward:

1. Log into your client portal

2. Navigate to the PAMM account section

3. Submit a withdrawal request

Take note that funds are typically processed within 24–48 hours.

What Is the Difference Between PAMM And MAM Accounts?

While both PAMM and MAM accounts allow for professionally managed trading, they differ in how trades are allocated.

PAMM accounts distribute profits and losses proportionally based on each investor’s share of the total fund. Meanwhile, MAM (Multi-Account Manager) accounts offer more flexibility for fund managers to assign different lot sizes to individual client account, providing a more customised allocation approach.

To learn more about MAM accounts at Vantage, read our article on “How MAM Accounts Work in South Africa”.

Disclaimer: Any information/content/material is intended for educational purposes whereas Vantage does not represent or warrant that the material provided here is accurate, current, or complete and cannot be held responsible for any miscalculation/mistake or omission. Any reliance on such information is strictly at your own risk. The information provided here, whether from a third party or not, is not to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any financial instruments; or to participate in any specific trading strategy and/or as investment advice. Any research provided does not have regard to the specific investment objectives, financial situation and needs of any specific person who may receive it. Please seek advice before making any trading decision. Past performance is not an indication of future performance. The information provided is not intended for distribution to, or use by, any person in any country where such distribution/use would be contrary to local laws.