Important Information

Thank you for visiting the Vantage Markets website. Please note that this website is intended for individuals residing in jurisdictions where accessing it is permitted by Vantage and its affiliated entities do not operate in your home jurisdiction.

By clicking 'I CONFIRM MY INTENTION TO PROCEED AND ENTER THIS WEBSITE', you confirm that you are entering this website solely based on your initiative and not as a result of any specific marketing outreach. You wish to obtain information from this website based on reverse solicitation principles, in accordance with the applicable laws of your home jurisdiction.

I CONFIRM MY INTENTION TO PROCEED AND ENTER THIS WEBSITE

Understanding PAMM Account

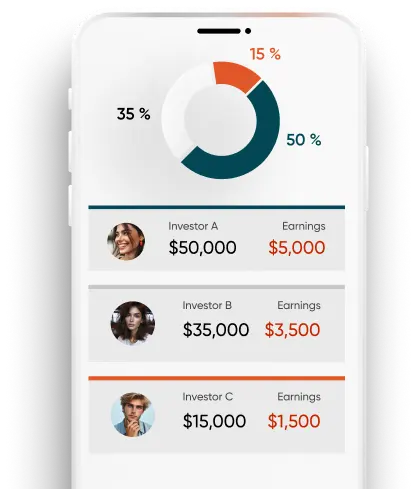

Percentage Allocation Money Management (PAMM) is a solution where a professional account manager executes trades on behalf of a diverse range of clients. In this setup, the account manager acts as the Fund Manager, while the clients are the Investors. The PAMM account allows investors to pool their funds together, providing them with access to professional fund managers and their trading strategies.

How Does PAMM Work?

Investors often face capital limitations when trading independently. To overcome this challenge, a PAMM account allows the Fund Manager to pool funds from multiple investors into a single trading strategy. This approach may benefit a diverse range of participants seeking access to sophisticated trading opportunities. Investors receive a share of the profits proportionate to their contribution to the PAMM account's capital.

For Fund Managers, a PAMM account provides access to significant funds and an opportunity to earn a performance fee. It serves as an effective means for investors to access high-capital trading strategies. Typically, the returns are shared based on the investors' contributed amount as a percentage of the total PAMM account's capital.

Why Choose a PAMM

Account?

PAMM accounts provide investors from diverse markets with an opportunity to leverage on the expertise of other investors, and pools funds together for potentially larger returns. Vantage facilitates this by offering unlimited investor admission into each of the funds. Moreover, the Fund Manager retains complete control over all trading decisions, ensuring efficient execution and management of the fund's trading strategy.

3 Simple Step to become a PAMM Master with Vantage

9 Reasons to Open a

Vantage PAMM Account

Trade with Our

PAMM System

Sign Up

Join one of the trusted multi-asset CFD brokers and select a PAMM program.

Fund into PAMM Account

Add your capital to the pooled investment account (PAMM account).

Share in Profits

Receive a share of the profits proportionate to their contribution to the PAMM account's capital.

PAMM Account Blogs

PAMM Account

FAQs

-

1

What is a PAMM account?

Percentage Allocation Money Management (PAMM) accounts, also referred to as Percentage Allocation Management Modules, are investment accounts offered by forex or CFD brokers. These accounts allow investors to pool their funds and have them managed by experienced traders and trade on their behalf. This system is popular among global traders, including those from rapidly growing markets seeking diversified investment opportunities.

-

2

Are PAMM accounts legit?

Yes, investing in PAMM accounts is a legitimate option for investors globally. PAMM accounts are offered by forex or CFD brokers. It is essential to choose a broker with a solid reputation and proper regulatory oversight to ensure the security and transparency of your investments.

-

3

What are the benefits of a PAMM account?

For partners, including global traders, managing accounts on behalf of their clients is streamlined with a PAMM account. It enables simultaneous management of all client accounts from a single platform, automatically distributing profits or losses proportionally, eliminating the need for individual account management.

-

4

How do I withdraw money from my PAMM account?

The performance fee will be calculated based on each trading interval (monthly, weekly, etc.). Once a trading interval is completed, the performance fee will be credited to the Fund Manager's Vantage IB wallet. The Fund Manager can then submit a withdrawal request through the Vantage portal to initiate the withdrawal process.

-

5

What is the difference between a PAMM and MAM account?

MAM and PAMM accounts differ in terms of fund allocation and management. In a PAMM account, a trader makes investment decisions for a pooled fund, with profits and losses distributed among investors based on their allocated percentages. In a MAM account, a manager trades proportionally across individual accounts, allowing investors to maintain control and customise their risk preferences.

Learn more about the differences between PAMM and MAM accounts.

Have a Question?

Get in Touch

If you have any questions or enquiries, fill in the form in this section. Alternatively, contact us at [email protected]. and one of our Account Managers will get back to you soon.

"*" indicates required fields